NVIDIA Corporation (NVDA) has been the king of AI stocks for quite a while now, with its GPUs driving the generative AI surge and pushing its market cap beyond a whopping $4 trillion. But as we wrap up 2025, we’re starting to see some serious cracks in this impressive facade. Right now, shares are sitting at about $175—down more than 12% just this November—and you can bet investors are starting to talk about a potential reckoning. Betting against NVDA isn’t just going against the grain; it’s a strategic move aimed at tackling overvaluation, slipping market share, and some accounting tricks that might be hiding bigger issues. Google’s Tensor Processing Units (TPUs) are stepping up as a more affordable alternative, while NVIDIA’s depreciation strategies seem to hint at something outdated. Plus, there’s no shortage of negative news—from export troubles with China to worries about an AI bubble—that suggests the good times might be coming to an end. If you’re on the hunt for reasons to short NVDA stock in 2025 or looking for some bearish analysis, this deep dive will show you why the chip giant’s heyday could be winding down. So get ready—the case for shorting is looking stronger than ever.

The TPU Tsunami: How Google’s Custom Chips Are Drowning NVIDIA’s GPU Dominance

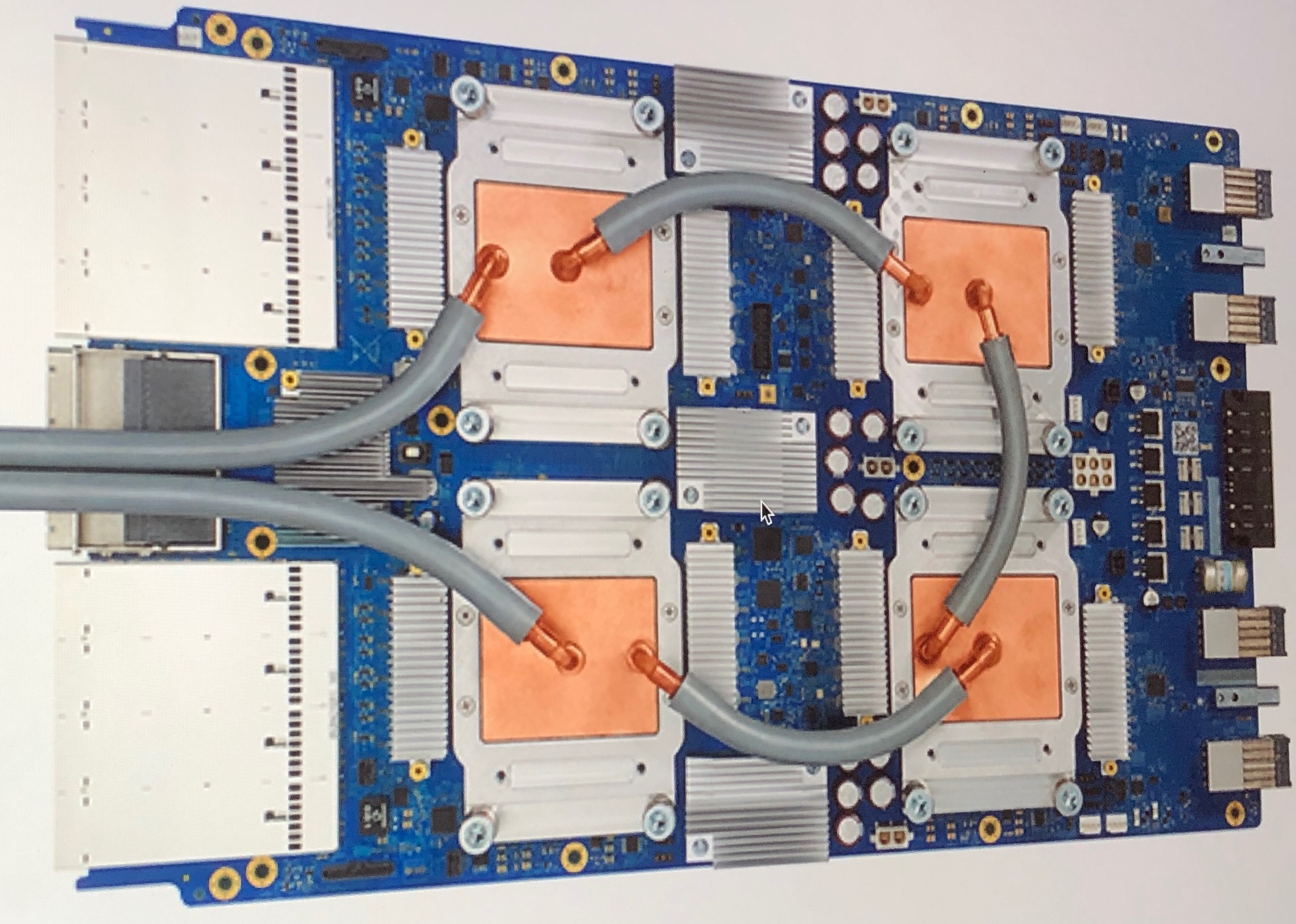

NVIDIA’s grip on the AI chip market is starting to slip, and Google’s TPUs are coming in hot like a battering ram. What was once seen as just an experimental tool for Google has really transformed into a powerful, energy-efficient option that’s catching the eye of hyperscalers and businesses looking to dodge NVIDIA’s high prices. By 2025, Google’s Ironwood TPU v7 is set to make waves with performance that’s up to twice as good per watt compared to earlier models. Plus, it supports massive clusters with over 9,000 chips using liquid cooling. That’s no exaggeration; it’s a significant threat to NVIDIA’s Hopper and Blackwell GPUs, which tend to drink up energy and come with hefty price tags. Think about the consequences here: Meta’s already in talks to roll out Google’s TPUs in their data centers, potentially racking up billions in orders that could’ve easily gone to NVIDIA. OpenAI, the go-to name for AI innovation, is already leveraging TPUs for training their models—showing they can handle heavy workloads just like AlphaZero did back in the day. Analysts from Forrester are saying TPUs can cut costs by 30-50% per petaflop compared to GPUs, making them super appealing for inference—the main focus now that training is shifting. When NVIDIA CEO Jensen Huang jokes that Blackwell leaves Hoppers “unwanted,” it really highlights how fast things are changing in this space. But Google’s yearly TPU roadmap (with v5e rolling out in 2023, Trillium v6 in 2024, and Ironwood in 2025) keeps pace with NVIDIA while being more efficient. For those betting against NVIDIA because of the “Google TPU threat,” the numbers don’t lie. NVIDIA’s data center revenue soared to $115.2 billion in FY2025—up by a whopping 142%—but as customers start adopting TPUs, we could see a drop of 10-20% by 2026 as they look to avoid relying on one vendor. Amazon’s Trainium3 chips are adding even more pressure, but Google’s strategy of integrating TPUs with their Gemini models builds a complete ecosystem that NVIDIA can’t match easily. With big players like Oracle questioning whether AI spending is sustainable, TPUs provide a more budget-friendly alternative. What’s NVIDIA’s answer? A bold blog post claiming they’re “a generation ahead,” but Wall Street doesn’t seem convinced—shares dropped by 3% just from the news about TPUs. This isn’t just competition; it feels more like commoditization. It might be time to think about shorting NVDA while this TPU wave gathers steam.

Unmasking the Depreciation Mirage: NVIDIA’s Accounting Smoke and Mirrors

NVIDIA’s FY2025 annual report is pretty mind-blowing at first glance—$130.5 billion in revenue, a whopping 75% gross margin, and $81.5 billion in operating income. But if you dig a little deeper, things start to look less stable. Michael Burry, the guy from “The Big Short,” isn’t holding back; he points out that hyperscalers are writing off NVIDIA-powered servers over five to six years. This could lead to an inflated earnings projection of $176 billion through 2028, especially since real GPU lifespans are more like two to three years, thanks to those yearly chip refreshes we keep hearing about. NVIDIA’s own reports back this up—its Q3 FY2026 depreciation shot up to $752 million from $478 million the previous year as their property and equipment costs ballooned. So why should we care about these “NVIDIA depreciation concerns”? Well, straight-line depreciation assumes these assets will maintain steady utility over time, but with AI evolving at lightning speed—like Jensen Huang saying Blackwell is already making Hoppers obsolete—we’re looking at some serious write-downs ahead. Companies like Meta and Google have already pushed server lifespans further into 2025, cutting down on depreciation costs by hundreds of millions and inflating their net income in the process. As the main supplier in this game, NVIDIA could face some tough times if demand drops; their 10-Q filing highlights just that risk. Burry’s betting against NVDA with his short positions because he thinks when reality strikes, those earnings will plummet and that seemingly low P/E ratio (below 25x) will disappear. For those who are bearish on NVIDIA, this is juicy stuff. Sure, they’ve got a massive cash pile of $43.2 billion that seems rock-solid right now, but with $30.8 billion tied up in supply commitments and demand cooling off, things could get tricky. Plus, as TPUs start taking over and relying less on GPUs, we might be staring down a wave of depreciation issues. Shorting NVDA now could be a smart move before this whole accounting illusion comes crashing down.

A Cascade of Negative Headlines: From China Bans to Bubble Bursts

NVIDIA’s 2025 isn’t just a shining example of success; it feels more like a maze filled with missteps. Remember when President Trump decided to ease things up in December? He approved sales of the H200 chip to China, but there’s a catch—25% of the revenue goes back to the U.S. Sounds like a good deal, right? Well, not really. NVDA’s market share in China is practically nonexistent because of export restrictions, and now Beijing’s looking into its own homegrown alternatives, which isn’t great news for H200 sales. Then there’s Oracle, which had a rough Q2—missing revenue targets and carrying an $11 billion debt on its shoulders, plus doubts about AI infrastructure. That sent NVIDIA’s stock down by 3.6% in a single day, pulling the whole sector down into what some are calling “bubble” territory. Even after their blockbuster Q3 results, shares dropped another 3.15% as traders jumped ship, reacting to fading Fed rate cuts and S&P rebalancing. And let’s not forget the broader feelings of fatigue around AI. On November 20, global stocks were all over the place, with NVIDIA’s earlier rally fizzling out fast. Barron’s even mentioned it was a “rough month,” hinting that maybe December could bring some relief—but that doesn’t do much for those shorting the stock. Oh, and if you’re looking for more bad news about NVIDIA, there’s AMD creeping in on their turf and Intel making a bit of a comeback too. Plus, Michael Burry publicly shorting NVIDIA looks like smart money bailing out. These aren’t just minor issues; they’re part of a perfect storm that seems to be shaking investor confidence pretty hard. With a trailing P/E ratio of 51x screaming “overbought” and YTD gains sitting at 34%, seeing shares pull back to around $100 doesn’t seem so outlandish anymore.

Final Verdict: Bet Against the AI Emperor

Shorting NVDA in late 2025 isn’t just a gamble; it’s more like doing the math. Google’s TPUs are chipping away at that once-impenetrable moat, and those inflated valuations are setting us up for a reality check. When the bad news hits, things are gonna deflate fast. Just look at Burry—he’s shown us that sometimes you gotta take risks to win big. If “short NVDA stock” is on your radar, you might want to jump in before everyone else does. The emperor’s GPU empire? Yeah, it’s looking pretty vulnerable right now.

Important Disclaimer

The article provided is for informational and educational purposes only. It represents the author’s opinion and analysis based on publicly available information and does not constitute financial advice, investment recommendation, or an endorsement of any trading strategy, including shorting NVIDIA (NVDA) or any other security.

We do not suggest, recommend, or advise buying, selling, shorting, or holding any stocks, options, or other financial instruments. All investment decisions carry risk, and you should conduct your own thorough research or consult a qualified financial advisor before making any investment choices.

The author, publisher, and any associated parties are not responsible or liable for any losses, damages, or consequences resulting from actions taken based on the content of this article. Past performance is not indicative of future results, and market conditions can change rapidly.

Investing involves substantial risk, including the potential loss of principal. Please invest responsibly.